Rare Earth Magnets May Demolish EV Dreams

Dr Arunaditya Sahay

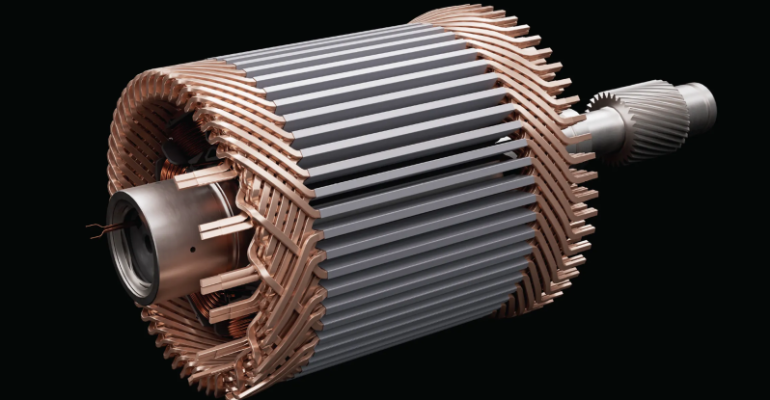

Both internal combustion engine (ICE) and battery powered vehicles serve the same

purpose of transportation. Whereas ICE vehicles use fossil fuel for energy, electric

vehicles use battery for powering electric vehicles (EV). The internal combustion engine

converts chemical energy into mechanical energy whereas the electric motor in EVs

converts the electrical energy into mechanical energy. Whenever we talk of EVs, the

purchase decision, apart from the cost, hinges around battery specifications. No doubt,

the battery of an electric Vehicle is the most important component but next to the

battery, the most important component of EV is the electric motor that needs to be

light weight, temperature resistant and must have high performing magnet. There are

four categories of permanent magnets; they are neodymium iron boron (NdFeB),

samarium cobalt (SmCo), alnico, and ceramic or ferrite magnets. Out of these

neodymium, iron and boron (Nd-Fe-B) permanent magnets, belonging to rare earth

elements (REE), are most suitable for EVs as they can withstand temperatures as high

as 230 degrees centigrade. Besides EV motors, they are also used for a variety of other

conventional automotive subsystems, such as anti-lock brakes, power steering, electric

windows, power seats, and audio speakers. In addition, REEs find use in satellite

communications, guidance systems, aircraft structures, computer hard disk drives, CDROMs, digital cameras, etc.

For the economic development and national security, Government of India have

defined critical materials to which REEs, too, belong. The lack of availability of these

minerals; if available the concentration of existence, the difficulty in extraction and

processing of these elements in few geographical locations in the world has led to

supply chain vulnerability disrupting national plans. The rare earth elements (REEs)

consist of 17 metals in Group 3 of the Periodic Table. They comprise of Lanthanide series

elements, Scandium and Yttrium (because of similar physical properties and found in

the same ores and deposits). Contrary to their name, they are moderately abundant in

nature but not concentrated enough to make them economically exploitable. India has

the fifth-largest rare earth resource globally (Table Below), the Indian REEs being mainly

concentrated in its monazite minerals.

| Global Availability of REEs | ||

| Country | Reserves of REEs (in tons of Oxide) | % Share |

| Australia | 3.400.000 | 2.56 |

| BraziI | 22.000.000 | 16.67 |

| Canada | 830 | 0.63 |

| China | 44 | 33.33 |

| Greenland | 1.5 | 1.14 |

| India | 6,900.00 | 5.23 |

| Malaysia | 30 | 0.02 |

| Malawi | 140 | 0.11 |

| Russia | 18.000.000 | 13.64 |

| South Africa | 8,60.000 | 0.65 |

| Vietnam | 2,20,00,000 | 16.67 |

| USA | 1.400.000 | 1.06 |

| World Reserves | 13,20,00,000 | 100 |

April 4, 2025 was the black day in the history of REEs when China’s Ministry of

Commerce imposed export restrictions on seven rare earth elements (REEs) as well as

on manufactured magnets which are used in many sectors of economy including

automotive, defence, and energy. This action was taken in retaliation to U.S. President

Donald Trump’s astronomical tariff increase on Chinese products. Unfortunately, India,

too, is caught in this cross fire between China and Russia. India’s position for REE and

magnet import from China has become further difficult with ‘Operation Sindoor’ that

resulted in India getting the custody of Chinese PL 15E missiles, both live and destroyed.

The new restrictions on export has been imposed on 7 of 17 REEs. These include

samarium, gadolinium, terbium, dysprosium, lutetium, scandium, and yttrium. The

Chinese companies need to secure special export license to export not only the minerals

but also permanent magnets. Apart from the tariffs, the cold war between China and

USA may be another cause for this retaliation as REEs, in addition to automobile and

energy, are crucial for a range of technologies in defence. They are used in F-35 fighter

jets, Virginia and Columbia class submarines, Tomahawk missiles, radar systems,

Predator unmanned aerial vehicles, and the Joint Direct Attack Munition series of smart

bombs. It will not be out of context to mention that F-35 fighter jet contains over 900

pounds of REEs whereas DDG-51, an Arleigh Burke class destroyer and Virginia class

submarine require approximately 5,200 pounds and 9,200 pounds respectively of rare

earth elements. Unfortunately, India, too, is caught in this cross fire between China and

Russia.

Until 2023, China accounted for 99% of world’s heavy Rare Earth Elements processing.

Vietnam, too, was doing REEs processing for names sake but their processing facility has

been closed down due to a tax dispute that arose during the last year. This gave China

a monopolistic position over the global supply of REEs. As of now, the United States is

on the back foot when it comes to manufacturing defence equipment which is based on

technologies that use REEs. To thwart this precarious situation, the United States has

caught hold of a Canadian Company, Aclara Resources, which will mine rare-earths in

Brazil, having second highest deposits of REEs, to supply a processing plant that the firm

has planned to build in U.S.A. This plant will be separating rare-earths deposits into

individual elements. Post this announcement, Aclara is facing a tsunami of demand as

the whole western world is seeking to establish alternative supply chain for REEs and

magnets needed by vital industries.

While India has fifth largest REE reserves, it lacks the advanced extraction and refining

capabilities, making her heavily dependent on China. Thus, India is in a difficult position

with regard to REEs and magnets. No doubt, Indian Rare Earth Limited has started

making magnets in its Vizag plant (annual capacity of 3,000 kg), the magnets produced

are samarium-cobalt permanent magnets. based on indigenous technology developed

by Bhabha Atomic Research Centre (BARC) and Defence Metallurgical Research

Laboratory (DMRL) using indigenous rare earth – Samarium. These magnets find

applications requiring high thermal stability, corrosion resistance, and reliable

performance in harsh environments, such as aerospace, military, and high-temperature

industrial uses. EVs, on the other hand, require high magnetic strength in compact sizes,

suitable for electric motors, that is fulfilled by Nd-Fe-B magnets which are imported

from China. Because of the restriction imposed by China on the export of these

magnets, Indian top EV manufacturers have already reached out to the Central

government through associated Ministries seeking their intervention to ensure

continued supply of critical minerals including rare earth elements (REE) as well as

magnets from China. PM schemes on green mobility is in jeopardy because of supply

restrictions by China. Price rise in EVs is imminent if shortages of supplies continue. Rare

earth magnets, particularly neodymium-iron-boron (NdFeB) magnets, are vital in EV

manufacturing. They provide strong magnetic fields that are required for the high

efficiency and performance of electric motors, especially traction motors that drive EVs.

Apart from other procedural hindrances, China is seeking government guarantee that

these critical mineral sources from them will not be used in weapon-making and will be

restricted for civilian usage only.

Last month, some of the EV makers had reached out to various connected Ministry

seeking continuity in supply of REEs, including these magnets. Though India has world’s

fifth largest deposit of REEs, the concentration of the required materials for EV is very

low. Even if a decision is taken to be self-dependent for REEs and EV magnets, the

gestation period for establishing a mine is very high and the extraction of the metals

from the mineral will require technology procurement/development. Therefore, for

short run, there is no alternative than to get the REEs/magnets from China whose new

policy is that rare earth magnets will be supplied to only those countries which provide

end-user certificates to Chinese suppliers in the prescribed format. It required further

that the importers must confirm that the magnets will not be used in weapons or

transferred to any third party. This declaration by the importers has to be certified by

the Ministry of External Affairs and sent to the Chinese exporter throu the Embassy of

China. According to the Automotive manufacturers represented by SIAM, the magnet

inventories is likely to last only till the end of June. Taking advantage of the situation,

the Chinese government is pressuring Indian EV manufacturers to import assembled

motors rather than the magnet used in the motor. This will not only increase the price

of the EV but also require design changes to fit Chinese motor in the assembly which

will further increase the cost and take considerable time for implementation. Both the EV industry, the central government and all connected ministries have to act fast so that

India’s EV dream is not shattered.

*Former CEO, SIL, presently Distinguished Professor, FSM

[wpforms id="5714"]

Categories

Latest Posts

Rare Earth Magnets May Demolish EV Dreams

May 26, 2025Are EVs Environment Friendly?

May 22, 2025B